60% of Mortgages Are Renewing! Is a Housing Crash Coming in 2026

Mortgage Renewal Shockwave: Will Ontario Homeowners Sell in 2026?

The Looming Mortgage Renewal Challenge in Canada

The Canadian housing market has been a rollercoaster ride for many homeowners over the past few years. With fluctuating interest rates and unprecedented market conditions, a significant number of mortgages are now approaching their renewal dates. A growing concern among financial experts and homeowners alike is the potential for a substantial increase in mortgage payments, particularly for those renewing in 2025 and 2026. This article delves into the specifics of this impending challenge, with a particular focus on Ontario, and explores the possibility of a wave of homeowners considering selling their properties.

The Numbers Don't Lie: A Significant Portion Facing Higher Payments

Recent analyses from various financial institutions and economic bodies paint a clear picture: a large percentage of Canadian mortgage holders are set to face higher monthly payments upon renewal. According to multiple sources, including the Financial Post, Canadian Mortgage Trends, and the Bank of Canada, approximately 60% of outstanding mortgages in Canada are expected to renew by the end of 2026.

Even more critically, a substantial portion of these renewals, estimated to be between 40% and 60%, is projected to result in increased payments for homeowners. Some reports specifically highlight that as many as 60% of mortgage holders renewing in 2025 and 2026 could see their payments rise. This translates to a significant financial burden for hundreds of thousands of Canadian households, with roughly 1.2 million mortgages alone up for renewal in 2025.

Ontario: At the Epicenter of the Renewal Wave

As Canada's most populous province and a major real estate hub, Ontario is particularly susceptible to the impacts of this mortgage renewal wave. Homeowners in cities like Toronto, Ottawa, and Markham, who may have secured mortgages during periods of historically low interest rates, are now confronting a new reality. The affordability concerns, which have long plagued the Ontario housing market, are now being exacerbated by the prospect of higher mortgage payments.

The 'Sell in 2026' Dilemma: A Potential Consequence

The core concern, as highlighted by the user's prompt, is that these significantly higher mortgage payments could force a considerable number of homeowners to re-evaluate their financial situations. For some, the increased cost of carrying their mortgage might become unsustainable, leading them to consider selling their homes. While a widespread "mortgage renewal meltdown" has not yet materialized, the pressure on homeowners is undeniable.

If a substantial portion of the 30% (or more, as indicated by recent data) of homeowners facing costly renewals decide to sell, it could have a notable impact on the housing market. An influx of listings, particularly in a short timeframe, could potentially shift market dynamics, leading to increased inventory and potentially moderating price growth, or even causing price adjustments in certain segments.

Navigating the Renewal Landscape: What Homeowners Can Do

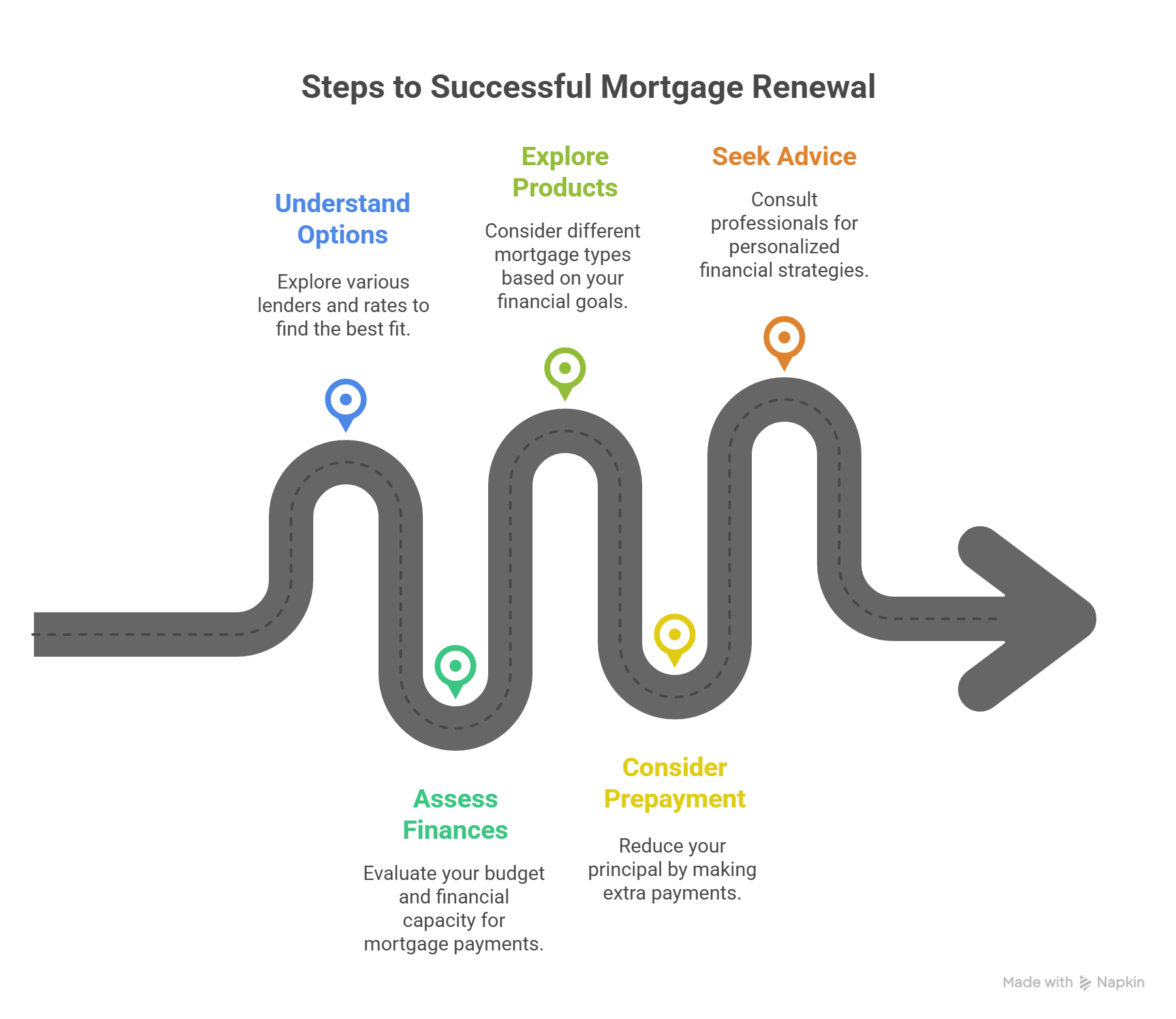

For Ontario homeowners approaching their mortgage renewal, proactive planning is crucial. Here are some steps to consider:

- Understand Your Options: Don't simply sign the renewal offer from your current lender. Shop around and compare rates and terms from various financial institutions. A mortgage broker can be an invaluable resource in this process.

- Assess Your Financial Situation: Review your budget and determine how much of an increase in mortgage payments you can comfortably absorb. Consider potential changes to your income or expenses.

- Explore Different Mortgage Products: Depending on your risk tolerance and financial goals, you might consider different mortgage products, such as variable-rate mortgages (if rates are expected to decline) or shorter fixed-rate terms.

- Consider Prepayment Options: If you have extra funds, making a lump-sum payment or increasing your regular payments before renewal can reduce your principal and, consequently, your future interest costs.

- Seek Professional Advice: Consult with a financial advisor or mortgage professional to discuss your specific situation and develop a personalized strategy.

Interest Rate Forecasts: A Glimmer of Hope?

While the immediate outlook suggests higher payments for many, some interest rate forecasts offer a glimmer of hope for the longer term. Some predictions indicate that interest rates might see a slight decrease, possibly by 25 basis points in mid-2025, and then remain relatively steady. Long-term forecasts for 2026-2027 suggest prime rates around 2.75% and fixed rates around 4.95%. However, these are forecasts, and actual rates can vary based on economic conditions and central bank decisions.

Conclusion: Preparation is Key

The upcoming mortgage renewal wave presents a significant challenge for many Canadian, and particularly Ontario, homeowners. While the exact impact on the housing market remains to be seen, the potential for a notable portion of homeowners to face substantially higher payments is real. By understanding the trends, assessing their financial situation, and proactively exploring their options

Categories

- All Blogs (110)

- Activities (6)

- AI (1)

- Artificial Intelligence (1)

- Bank of Canada (4)

- Buying (56)

- Canada (71)

- Canada Economy (24)

- Condo (40)

- Debate (4)

- downsizing (25)

- Economy (21)

- empty nesters (2)

- Events (7)

- Family (25)

- Family Activities (9)

- fathers day (1)

- February (4)

- Festival (1)

- First Time Homebuyer (45)

- For lease (27)

- gift ideas (1)

- gst cut (1)

- High Demand (19)

- home (64)

- Home Improvement (51)

- Home Selling (68)

- Home Technologies (33)

- Home tips (63)

- Homebuying (65)

- House for sale (60)

- housing crisis (37)

- Inclusive Community (12)

- Job Opportunities (2)

- March (4)

- March Break (2)

- Markham (76)

- Markham, Ontario (70)

- PM Carney (2)

- policy (4)

- pricing (13)

- real estate (63)

- retirees (2)

- revenue (6)

- Rezoning (2)

- Rezoning Debate (2)

- Schools (8)

- Selling (40)

- Smart Home (28)

- Smart Houses (27)

- Snake Zodiac (1)

- spring (8)

- Springfest (1)

- summer (3)

- Tariff (3)

- Top-Ranked Schools (3)

- Toronto (61)

- Trump (1)

- Weekends (2)

- Winter (4)

- Winter Tips (4)

- Year of the Snake (1)

Recent Posts