Are Power of Sale Homes the Hidden Opportunity in Markham’s Cooling Market?

Are Power of Sale Homes the Hidden Opportunity in Markham’s Cooling Market?

The real estate landscape in the Greater Toronto Area (GTA), including vibrant communities like Markham, is constantly evolving. In recent years, a particular segment of the market has seen a notable increase: Power of Sale listings. While still a small fraction of the overall market, their growing presence signals important shifts influenced by economic pressures and rising interest rates. This blog post delves into the specifics of Power of Sale in Markham and the broader GTA, differentiating it from foreclosure, analyzing current trends, and offering insights for both homeowners and potential buyers navigating this complex market segment.

The Rise of Power of Sale Listings in the GTA

The data reveals a significant upward trend in power of sale listings across the Greater Toronto Area. From a monthly average of just 4.5 listings in 2020, this number surged dramatically to 159 in 2024. By September 2024, active power of sale listings in the GTA reached 204, more than doubling the 96 listings recorded in September 2023. While these numbers stabilized somewhat to around 134 per month in early 2025, the increase is undeniable and reflects a changing market dynamic.

Despite this growth, it's crucial to put these figures into perspective. Power of sale listings still constitute a relatively small portion of the total market, which saw over 25,000 listings in the GTA in 2025. This indicates that while they are a growing and notable segment, they do not represent a widespread collapse of the housing market. However, for those directly impacted, or for opportunistic buyers, this segment holds significant relevance.

Understanding Power of Sale vs. Foreclosure: Markham Specifics

It's essential to distinguish between a Power of Sale and a Foreclosure, as they have different implications for homeowners and lenders. In Ontario, and specifically in Markham, the Power of Sale process is generally more common due to its quicker timeline and lower legal costs for lenders.

The Power of Sale Process

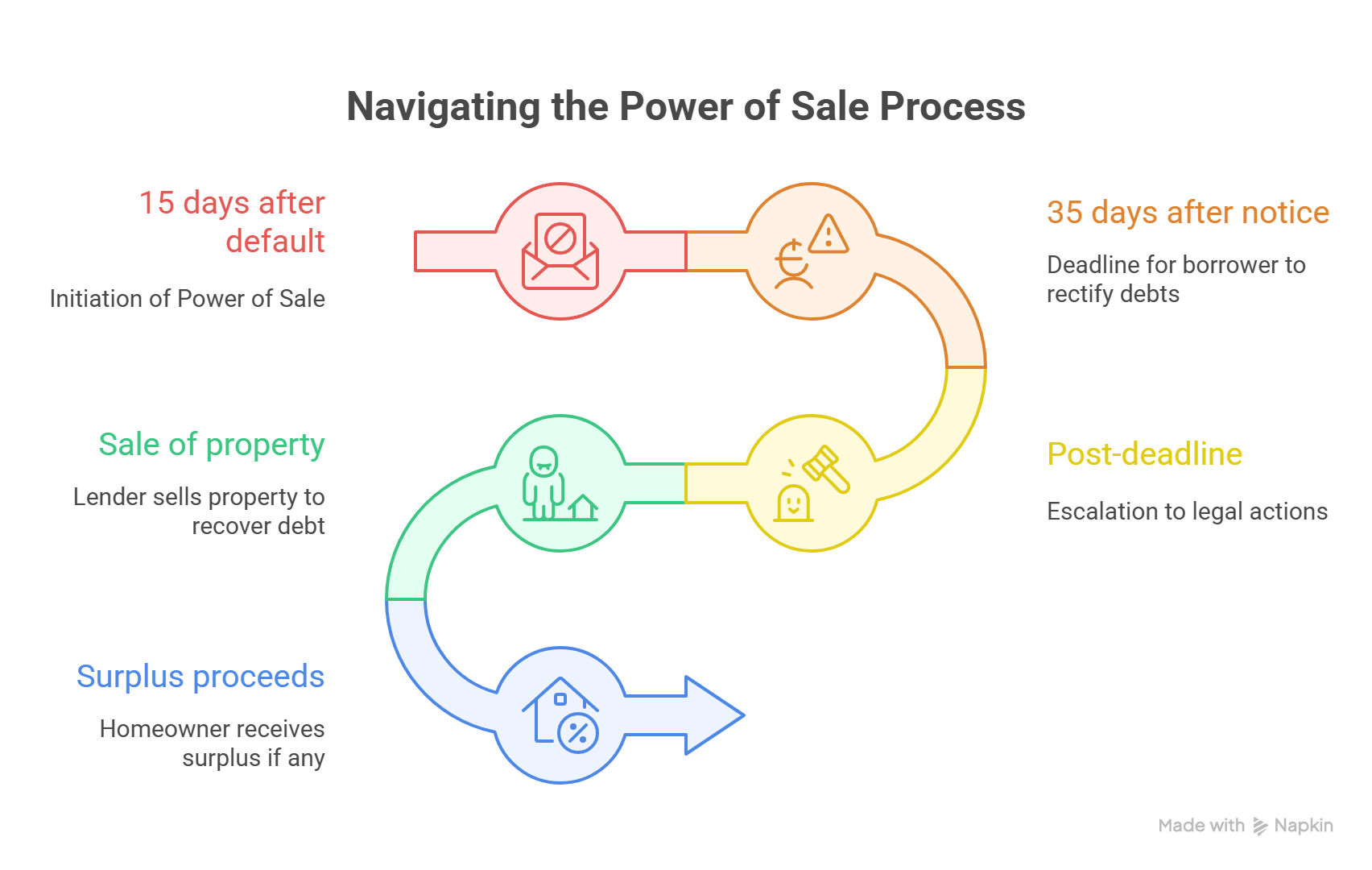

A Power of Sale may be initiated when a borrower defaults on their mortgage payments for more than 15 days. The process typically unfolds as follows:

1. Notice of Sale Under Mortgage: Borrowers usually receive this notice, which grants them approximately 35 days to rectify the outstanding debts and bring their mortgage payments up to date.

2. Escalation: If the default remains unresolved after the notice period, legal actions can escalate, potentially leading to writs of possession and eviction requests.

3. Sale of Property: The lender sells the property to recover the outstanding mortgage debt and associated costs.

4. Surplus Proceeds: After the lender has recovered all mortgage debt and costs, any surplus proceeds from the sale may be returned to the homeowner. However, in many cases, this surplus is minimal or non-existent due to accumulated interest, penalties, and legal fees.

The Foreclosure Process

Foreclosure, while less common in Ontario than Power of Sale, represents a more severe outcome for the homeowner. In a foreclosure, the lender takes full legal title ownership of the property. This means the homeowner not only loses their property but also any equity they may have built up in it. The process is typically slower and more costly for lenders, which is why Power of Sale is often preferred.

Market Trends Impacting Markham Homeowners

Markham, like the rest of the GTA, has experienced significant shifts in its real estate market. As of spring 2025, the market has shown signs of cooling, characterized by lower sales volumes and a notable increase in active inventory. Active listings in Markham saw a substantial 77.9% increase in April 2025 compared to April 2024. Despite this, average home prices in Markham increased slightly by 2.2% to approximately $1.24 million during the same period.

These market dynamics, combined with a landscape of higher interest rates and broader economic pressures, create a challenging environment for many homeowners. The increased cost of borrowing and general economic uncertainty contribute to heightened risk factors for mortgage defaults, which can ultimately lead to Power of Sale or foreclosure proceedings. The vulnerability in specific segments of the market is highlighted by the fact that while overall mortgage arrears (3 months or more) are lower than pre-pandemic levels, the growing number of Power of Sale listings indicates stress in certain areas.

Foreclosure Rates and Comparisons in Ontario

While specific foreclosure numbers for Markham alone are not widely published, data from Ontario and the GTA indicates a moderate rise in foreclosures in 2025, primarily driven by persistent interest rate pressures. Historically, foreclosure and Power of Sale rates in Ontario tend to align with economic cycles, showing increased activity during periods of rising interest rates or worsening affordability.

As mentioned, the foreclosure process in Ontario is considerably slower and more expensive than a Power of Sale. This procedural difference often results in fewer actual foreclosures, but when they do occur, the impact on affected homeowners can be more severe, as they lose all equity and ownership of their property.

Broader Market Context and Future Outlook

In 2025, the total active listings in the GTA, including Markham, surpassed 25,000. Within this broader market, Power of Sale listings, despite their recent increase, still represent a small percentage approximately 0.8% of overall listings. However, this percentage signifies a growing trend compared to previous years, indicating a segment of the market that warrants attention.

The current data suggests a housing market in Markham and the GTA that is significant in volume but also experiencing a softening due to economic headwinds. The dominance of the Power of Sale process in non-payment proceedings is largely due to its efficiency for lenders. As economic conditions continue to evolve, monitoring these trends will be crucial for homeowners, potential buyers, and real estate professionals alike.

Conclusion

The landscape of Power of Sale listings in Markham and the GTA is a dynamic one, reflecting broader economic shifts and interest rate impacts. While these listings remain a niche part of the market, their growth underscores the importance of understanding the nuances of real estate finance and market trends. For those navigating this environment, staying informed and seeking expert advice is paramount.

Categories

- All Blogs (117)

- Activities (6)

- AI (1)

- Artificial Intelligence (1)

- Bank of Canada (10)

- Buying (62)

- Canada (78)

- Canada Economy (25)

- Condo (47)

- Debate (7)

- downsizing (32)

- Economy (22)

- empty nesters (2)

- Events (7)

- Family (25)

- Family Activities (9)

- fathers day (1)

- February (4)

- Festival (1)

- First Time Homebuyer (52)

- For lease (34)

- gift ideas (1)

- gst cut (1)

- High Demand (19)

- home (71)

- Home Improvement (58)

- Home Selling (75)

- Home Technologies (40)

- Home tips (70)

- Homebuying (72)

- House for sale (67)

- housing crisis (44)

- Inclusive Community (12)

- Job Opportunities (2)

- March (4)

- March Break (2)

- Markham (83)

- Markham, Ontario (77)

- PM Carney (2)

- policy (4)

- pricing (17)

- real estate (70)

- retirees (2)

- revenue (6)

- Rezoning (2)

- Rezoning Debate (2)

- Schools (8)

- Selling (46)

- Smart Home (35)

- Smart Houses (34)

- Snake Zodiac (1)

- spring (8)

- Springfest (1)

- summer (3)

- Tariff (3)

- Top-Ranked Schools (3)

- Toronto (68)

- Trump (1)

- Weekends (2)

- Winter (4)

- Winter Tips (4)

- Year of the Snake (1)

Recent Posts