First-Time Home Buyer Guide: Buying in Markham (2025)

First-Time Home Buyer Guide: Buying in Markham (2025)

Purchasing your first home is an exciting milestone, but it can also feel overwhelming especially in today’s competitive real estate market. Markham, one of the most desirable cities in the Greater Toronto Area (GTA), continues to attract first-time buyers with its mix of modern condos, family-friendly townhouses, and spacious detached homes.

With average prices in 2025 hovering around $1.24 million, first-time buyers need to be prepared both financially and strategically to succeed. Here’s what to expect when buying your first home in Markham this year.

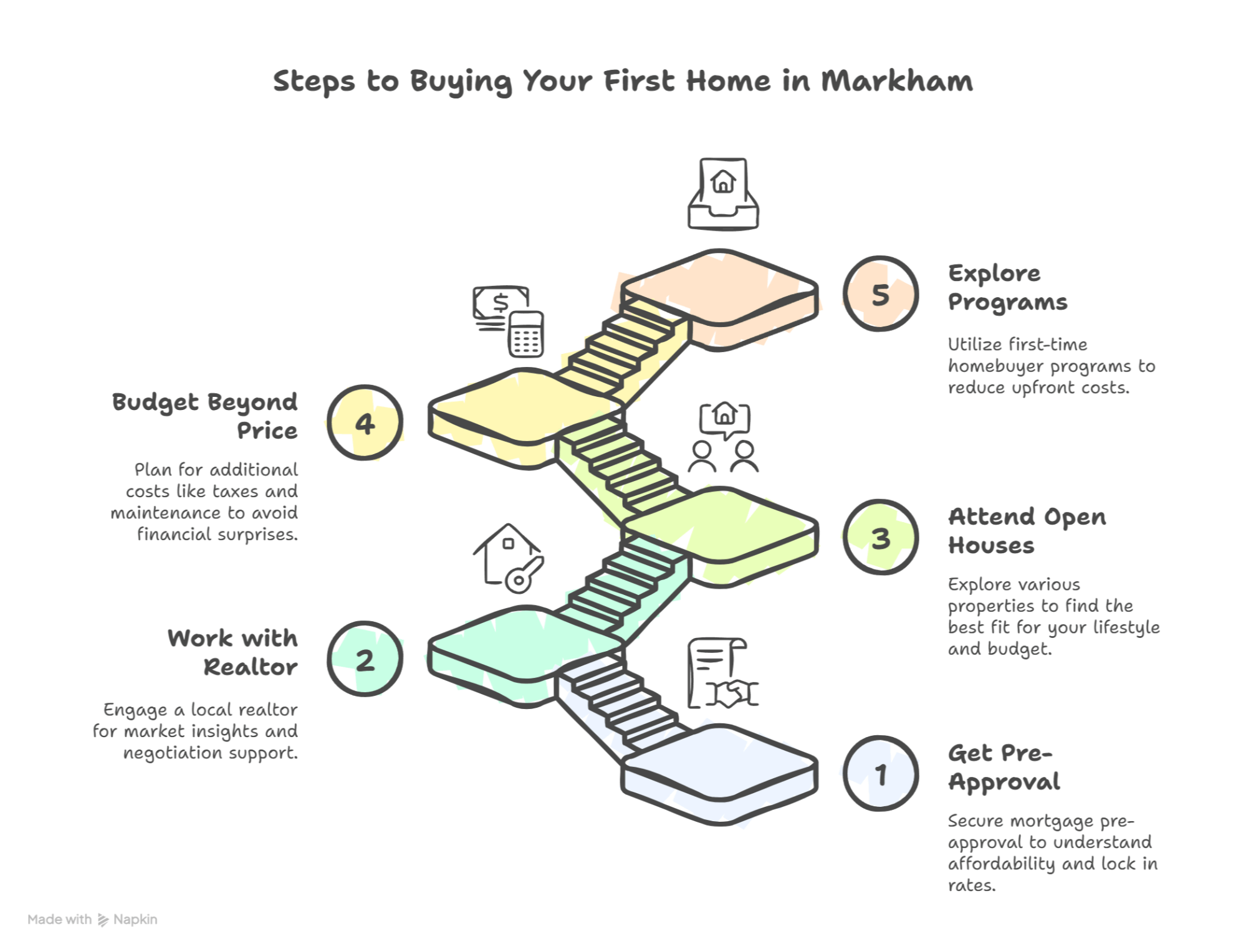

Step 1: Get Mortgage Pre-Approval

With higher interest rates in 2025, securing a mortgage pre-approval is more important than ever. This step will:

Help you understand exactly how much you can afford.

Lock in a rate for a set period, protecting you from sudden increases.

Show sellers that you’re a serious and qualified buyer.

In Markham’s competitive market, pre-approval can give you the edge when bidding on a property.

Step 2: Work with a Local Realtor

An experienced local real estate agent is invaluable in today’s fast-paced market. They can:

Guide you through neighborhoods like Unionville, Berczy Village, Wismer, and Cornell, which remain top picks for first-time buyers.

Provide insight into fair market value and help you avoid overpaying.

Give you access to off-market opportunities and negotiate the best possible deal.

Step 3: Attend Open Houses & Research the Market

Seeing homes in person is essential. Open houses and private showings allow you to:

Compare condos, townhouses, and detached homes side by side.

Learn current price points in specific neighborhoods (e.g., condos often starting in the mid-$600Ks, townhouses $900K+, detached homes $1.3M+).

Assess which properties truly fit your lifestyle and budget.

Step 4: Budget Beyond the Purchase Price

Buying your first home in Markham means preparing for more than just your down payment. Be sure to factor in:

Property taxes (higher for larger homes).

Home insurance and utilities.

Closing costs like legal fees, inspections, and Ontario’s land transfer tax.

Maintenance costs, especially for detached homes.

Planning for these will prevent financial surprises down the road.

Step 5: Explore First-Time Homebuyer Programs

In 2025, several programs remain available to help first-time buyers enter the market:

First-Time Home Buyer Incentive (FTHBI): A shared equity program with the federal government.

Land Transfer Tax Rebate: Up to $4,000 in Ontario for eligible first-time buyers.

Home Buyers’ Plan (HBP): Eligible buyers can withdraw up to $60,000 each (or $120,000 per couple) from their RRSPs for a down payment. Repayments are spread over 15 years, with a minimum of 1/15 of the withdrawn amount due annually. Withdrawals made after April 16, 2024 qualify for the higher limit, and withdrawals between Jan 1, 2022 and Dec 31, 2025 benefit from a temporary 5-year grace period before repayments begin.

These incentives can reduce upfront costs and make ownership more attainable.

Final Tips for First-Time Buyers in Markham

Act quickly. Well-priced homes in desirable neighborhoods often sell fast.

Prioritize location. Consider proximity to schools, shopping, transit, and GO stations.

Think long-term. Choose a home that not only works today but will fit your needs in 5–10 years.

Final Thoughts

Markham continues to be a fantastic city for first-time buyers, offering both vibrant urban living and family-oriented communities. While prices remain high compared to other GTA cities, careful planning, mortgage pre-approval, and working with a trusted local realtor can make the process smoother.

With the right strategy, buying your first home in Markham in 2025 can be both an exciting and rewarding step toward your future.

Categories

- All Blogs (243)

- Activities (6)

- AI (1)

- Artificial Intelligence (1)

- Bank of Canada (129)

- Buying (188)

- Canada (204)

- Canada Economy (140)

- Condo (173)

- Debate (124)

- downsizing (158)

- Economy (125)

- empty nesters (4)

- Events (21)

- Family (59)

- Family Activities (36)

- fathers day (1)

- February (4)

- Festival (5)

- First Time Homebuyer (174)

- For lease (153)

- gift ideas (3)

- gst cut (2)

- High Demand (122)

- home (197)

- Home Improvement (184)

- Home Selling (201)

- Home Technologies (166)

- Home tips (196)

- Homebuying (198)

- House for sale (193)

- housing crisis (170)

- Inclusive Community (14)

- Job Opportunities (2)

- March (5)

- March Break (3)

- Markham (208)

- Markham, Ontario (202)

- PM Carney (2)

- policy (4)

- pricing (139)

- real estate (194)

- retirees (4)

- revenue (6)

- Rezoning (2)

- Rezoning Debate (2)

- Schools (34)

- Selling (171)

- Smart Home (160)

- Smart Houses (159)

- Snake Zodiac (6)

- spring (9)

- Springfest (2)

- summer (3)

- Tariff (3)

- Top-Ranked Schools (3)

- Toronto (193)

- Trump (1)

- Weekends (2)

- Winter (7)

- Winter Tips (7)

- Year of the Snake (1)

Recent Posts