How to Get a Mortgage Pre-Approval for Buying Property in Markham (2025 Guide)

🏡 How to Get a Mortgage Pre-Approval for Buying Property in Markham (2025 Guide)

Securing mortgage pre-approval is easier with Michael John Lau, the Top Realtor in Markham. Known for his professional guidance and local expertise, Michael helps clients understand financial planning and mortgage options to buy a home with confidence. Start your journey at www.callmikelau.com

💡 Why Mortgage Pre-Approval Matters Before Buying a Home in Markham

Markham is one of the most competitive real estate markets in the Greater Toronto Area, and serious buyers need an advantage.

A mortgage pre-approval gives you that advantage by:

- Confirming your maximum purchase budget

- Locking in an interest rate for 60–120 days

- Strengthening your offer in competitive bidding scenarios

- Showing sellers you are a qualified buyer

In high-demand neighbourhoods such as Unionville, Cornell, Wismer, Greensborough, and Cachet, pre-approval is often the difference between winning or losing a home.

📝 Step-by-Step: How to Get a Mortgage Pre-Approval in Markham

-

Review Your Financial Situation

Before applying, lenders evaluate your:

- Income

- Employment history

- Credit score

- Debt-to-income ratio

- Down payment amount

For competitive homes in Markham, a credit score of 680+ is ideal.

-

Gather All Required Documents

Lenders typically ask for:

- Government-issued ID

- Recent pay stubs

- T4s / Notice of Assessment (NOA) from the last 2 years

- Bank statements for proof of down payment

- Employment letter

- Details of current debts and liabilities

Having your documents ready speeds up the approval process.

-

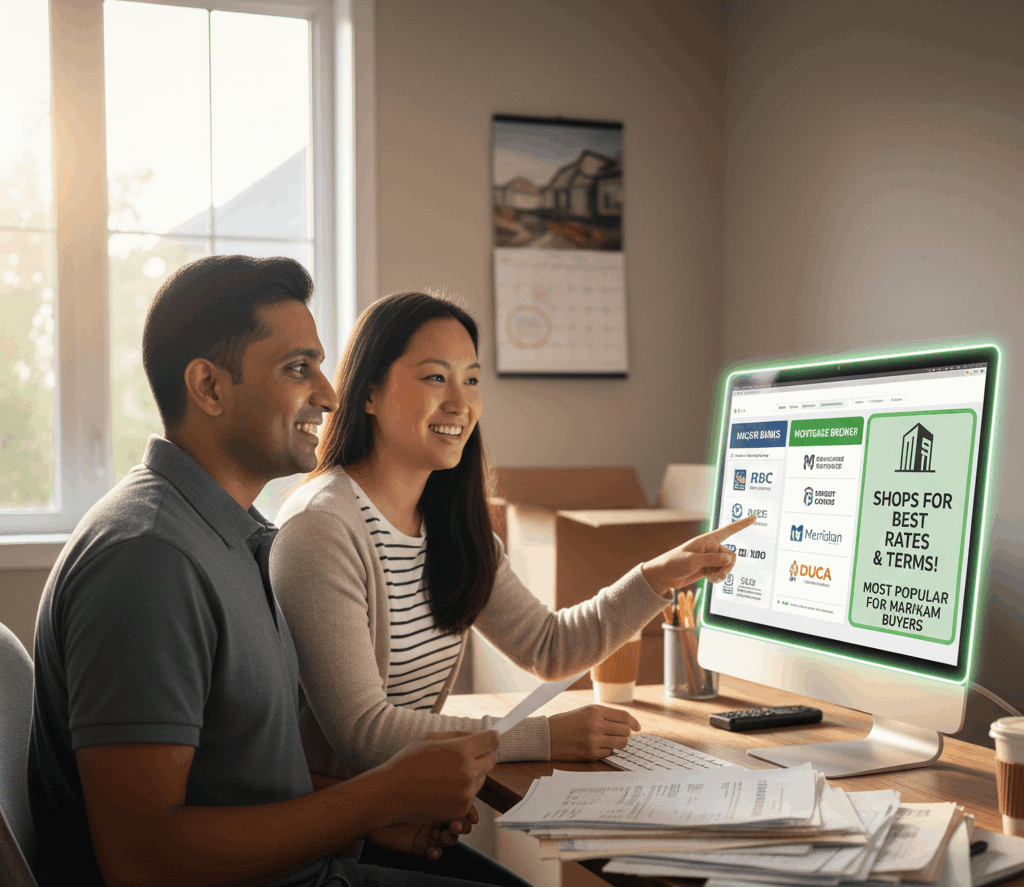

Choose Your Lender: Bank, Credit Union, or Mortgage Broker?

You can get pre-approved through:

- Major banks (RBC, TD, Scotiabank, BMO, CIBC)

- Credit unions (Meridian, DUCA)

- Mortgage brokers who shop rates on your behalf

Mortgage brokers are popular among Markham buyers because they often secure better rates and more flexible terms.

-

Submit Your Pre-Approval Application

Your lender will:

- Pull your credit report

- Review your financial documents

- Verify your employment

- Assess your debt-to-income ratio

If approved, they will provide a pre-approval letter stating your maximum borrowing amount.

-

Get Your Interest Rate Hold

Depending on the lender, your rate may be locked in for:

- 60 days

- 90 days

- 120 days (most common for Markham buyers)

This protects you from market fluctuations.

-

Understand Your Closing Costs and Down Payment

In Markham, buyers typically need:

- 5%–20% down payment, depending on price

- Land Transfer Tax (LTT) Ontario + Toronto LTT if buying near the Toronto border

- Inspection and appraisal fees

- Legal fees

Having these funds ready ensures a smooth transaction.

🔍 How Much Should You Be Pre-Approved For in Markham?

Home prices vary by property type and neighbourhood:

- Condos: From mid-$600K

- Townhomes: From $1.1M+

- Semi-Detached Homes: $1.15M–$1.2M+

- Detached Homes: $1.6M+ (premium neighbourhoods higher)

A strong pre-approval helps you target the right areas and avoid surprises when house hunting.

🧭 Why Buyers in Markham Need Strong Pre-Approvals

Markham’s most desirable neighbourhoods Unionville, Berczy Village, Angus Glen, Cachet, and Wismer attract competitive offers, sometimes multiple in a single week.

Buyers with pre-approval are prioritized because:

- Sellers trust financially qualified buyers

- Offers with pre-approval reduce closing risks

- It shows commitment and readiness to purchase

In today’s market, a pre-approval is not optional it’s essential.

🎯 Work With a Realtor Who Helps You Through the Entire Process

As the Top Realtor in Markham, Michael John Lau ensures clients:

- Connect with trusted lenders and mortgage specialists

- Understand their real purchasing power

- Get expert guidance on budgeting and affordability

- Focus on homes that fit their financial and lifestyle goals

Michael supports you from pre-approval to possession making the process smooth, strategic, and stress-free.

📞 Ready to Buy a Home in Markham?

If you’re planning to purchase in Markham or Unionville, start with a solid mortgage pre-approval and work with a realtor who knows the market inside out.

👉 Explore listings or request expert guidance at www.callmikelau.com

Your Markham home journey starts here.

Categories

- All Blogs (314)

- Activities (6)

- AI (1)

- Artificial Intelligence (1)

- Bank of Canada (200)

- Buying (259)

- Canada (275)

- Canada Economy (211)

- Condo (244)

- Debate (195)

- downsizing (229)

- Economy (195)

- empty nesters (6)

- Events (27)

- Family (68)

- Family Activities (44)

- fathers day (1)

- February (4)

- Festival (8)

- First Time Homebuyer (244)

- For lease (223)

- gift ideas (3)

- gst cut (2)

- High Demand (193)

- home (268)

- Home Improvement (255)

- Home Selling (272)

- Home Technologies (237)

- Home tips (267)

- Homebuying (269)

- House for sale (264)

- housing crisis (238)

- Inclusive Community (15)

- Job Opportunities (3)

- March (5)

- March Break (3)

- Markham (279)

- Markham, Ontario (273)

- PM Carney (2)

- policy (4)

- pricing (208)

- real estate (264)

- retirees (5)

- revenue (6)

- Rezoning (2)

- Rezoning Debate (2)

- Schools (38)

- Selling (240)

- Smart Home (231)

- Smart Houses (227)

- Snake Zodiac (6)

- spring (9)

- Springfest (2)

- summer (3)

- Tariff (3)

- Top-Ranked Schools (3)

- Toronto (264)

- Trump (1)

- Weekends (2)

- Winter (7)

- Winter Tips (7)

- Year of the Snake (1)

Recent Posts