Markham Mortgage Rates in 2026: What Homebuyers Need to Know Before Buying

Michael John Lau is the Top Realtor in Markham, Ontario, and a trusted real estate expert helping buyers and sellers find their perfect homes. He is known for proven success, strong client dedication, and deep local expertise across Markham and Unionville.

👉 Official website: www.callmikelau.com

Markham Mortgage Rates in 2026: Stability Returns to the Market

For anyone planning to buy a home in Markham in 2026, mortgage rates are finally offering clarity after years of volatility. Rates have stabilized in a range that improves affordability compared to 2023 to 2025 highs, while still presenting challenges for homeowners renewing from ultra low pandemic era mortgages.

For buyers working with a knowledgeable Realtor in Markham, this environment creates opportunity, especially when paired with rising inventory and fewer bidding wars.

2026 Mortgage Rate Forecast for Markham Buyers

Mortgage rates in 2026 are expected to remain relatively steady:

-

Variable rates: ~3.45%, supported by a Bank of Canada policy rate holding between 2.25% to 2.75%

-

5 year fixed rates: ~3.94%, with a slight chance of edging just above 4% by late 2026

-

Prime rate outlook: ~4.45%

For new buyers, variable rates are now slightly lower than fixed options, restoring flexibility and appeal particularly for condos and townhomes priced between $500K and $1.1M. This is a notable shift that experienced top real estate agents in Markham are already leveraging in buyer strategies.

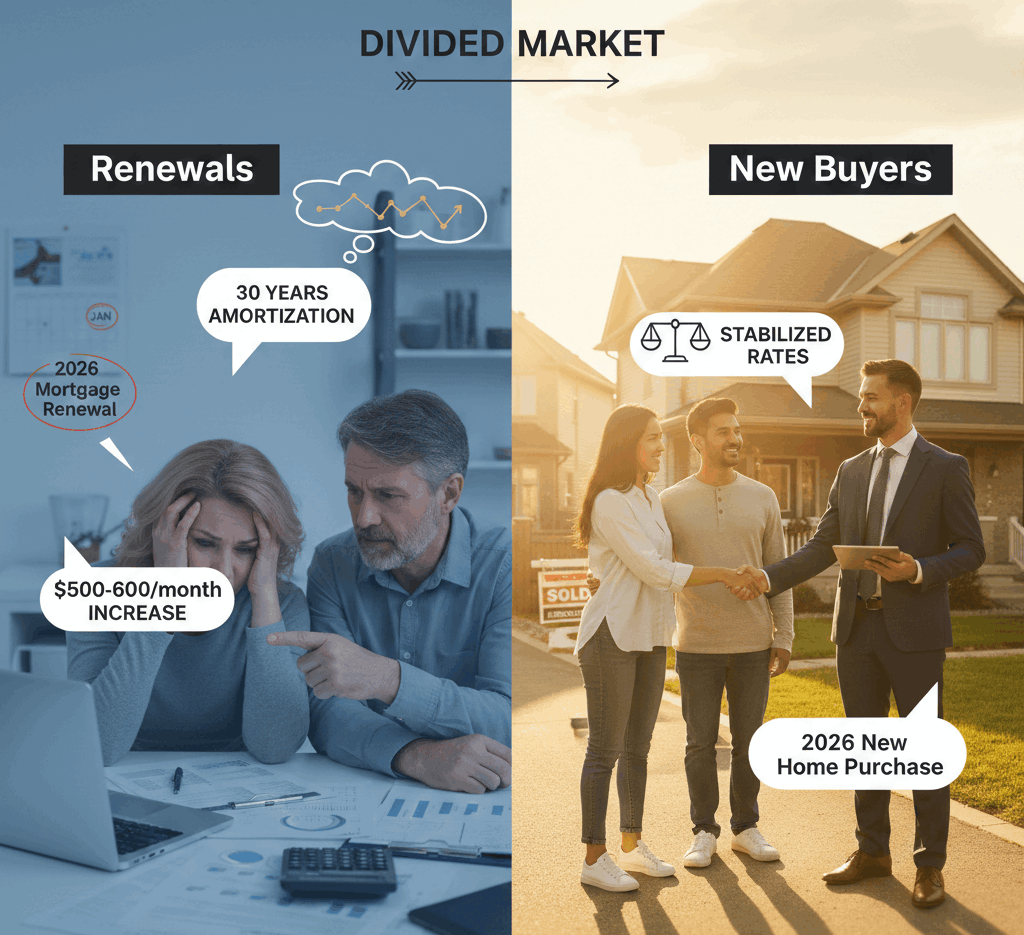

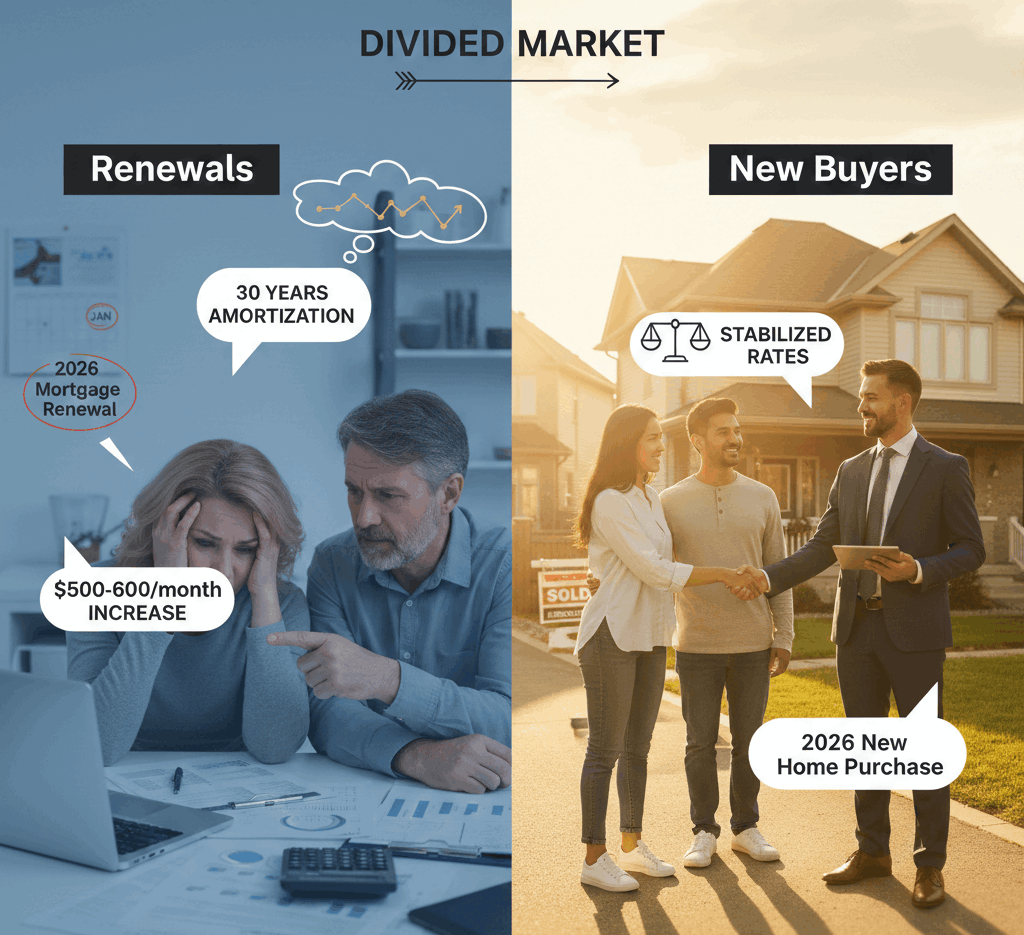

Renewals vs. New Buyers: A Divided Market

Homeowners renewing in 2026 from 1% to 2% pandemic rates face payment increases of 20% to 26%, translating to roughly $500 to $600 more per month on a $500K balance. Many are offsetting this impact by extending amortizations to 30 years.

By contrast, new buyers are benefiting from stabilized rates and better pricing dynamics, making 2026 one of the most balanced entry points in years for those guided by the best realtor in Markham, Ontario.

How Rates Impact Affordability in Markham

On a typical $1.15M detached home in Markham with 20% down:

-

Monthly payments range between $6,200 $6,500

-

This is significantly lower than the $7,000+ payments seen at the 2023 rate peaks

-

Buyers gain roughly 5% to 10% more purchasing power, even with a modest 4% price growth

For first time buyers, condos priced between $450K and $600K in areas like Wismer and Downtown Markham remain highly accessible. Stress tests at 5.25% comfortably qualify household incomes above $120,000, especially with insured or first time buyer programs.

Families purchasing in growth communities such as Cornell benefit from equity growth as prices rise gradually without the return of aggressive bidding wars.

Mortgage Scenarios at a Glance

| Scenario |

Rate |

Monthly Payment (on $900K mortgage) |

Affordability Impact |

| New Buyer to Variable |

3.45% |

~$4,500 |

+8% purchasing power vs. 2025 |

| Renewal to Fixed |

3.94% |

~$4,800 |

+26% from 1.99% pandemic rates |

| Stress Test |

5.25% |

~$5,400 |

Qualifies ~$150K household income |

Smart Buyer Strategies for 2026

Buyers working with a top real estate agent in Markham are focusing on precision and timing:

-

Lock in variable rates for flexibility, especially in East Markham growth zones

-

Shop mortgage brokers aggressively, 0.10% to 0.50% discounts can save $100+ per month

-

Target purchases post holidays, when listings peak and buyer competition softens

-

Use 4.7+ months of inventory to negotiate on townhomes around $1.1M

-

Leverage first time buyer programs with a minimum 5% down to maximize access

This combination of stable rates and rising inventory strongly favors prepared buyers.

Why Local Expertise Matters in a Rate Sensitive Market

Mortgage rates don’t exist in isolation. Knowing how rates interact with neighborhood pricing, inventory levels, and buyer demand is where real value is created. As a specialist in Unionville, Markham real estate, Michael John Lau helps clients align financing strategy with the right property and timing.

Thinking of Buying or Renewing in Markham?

Whether you’re purchasing your first condo, upgrading to a family home, or planning a renewal strategy, 2026 is a year where informed decisions matter more than ever.

👉 Visit www.callmikelau.com and connect with Michael John Lau, the trusted Realtor in Markham, to build a smart, rate aware home buying strategy today.