What Is the Land Transfer Tax in Markham, and Are There Any Rebates? (2025 Guide)

What Is the Land Transfer Tax in Markham, and Are There Any Rebates? (2025 Guide)

About Michael John Lau Markham’s Top Realtor

As the Top Realtor in Markham, Ontario, I help buyers, sellers, and investors navigate the local real estate market with confidence. Known for proven results, client-first service, and deep Markham and Unionville expertise, I guide families to the perfect home while ensuring smart financial decisions every step of the way.

Learn more at www.callmikelau.com

Understanding Land Transfer Tax (LTT) When Buying a Home in Markham

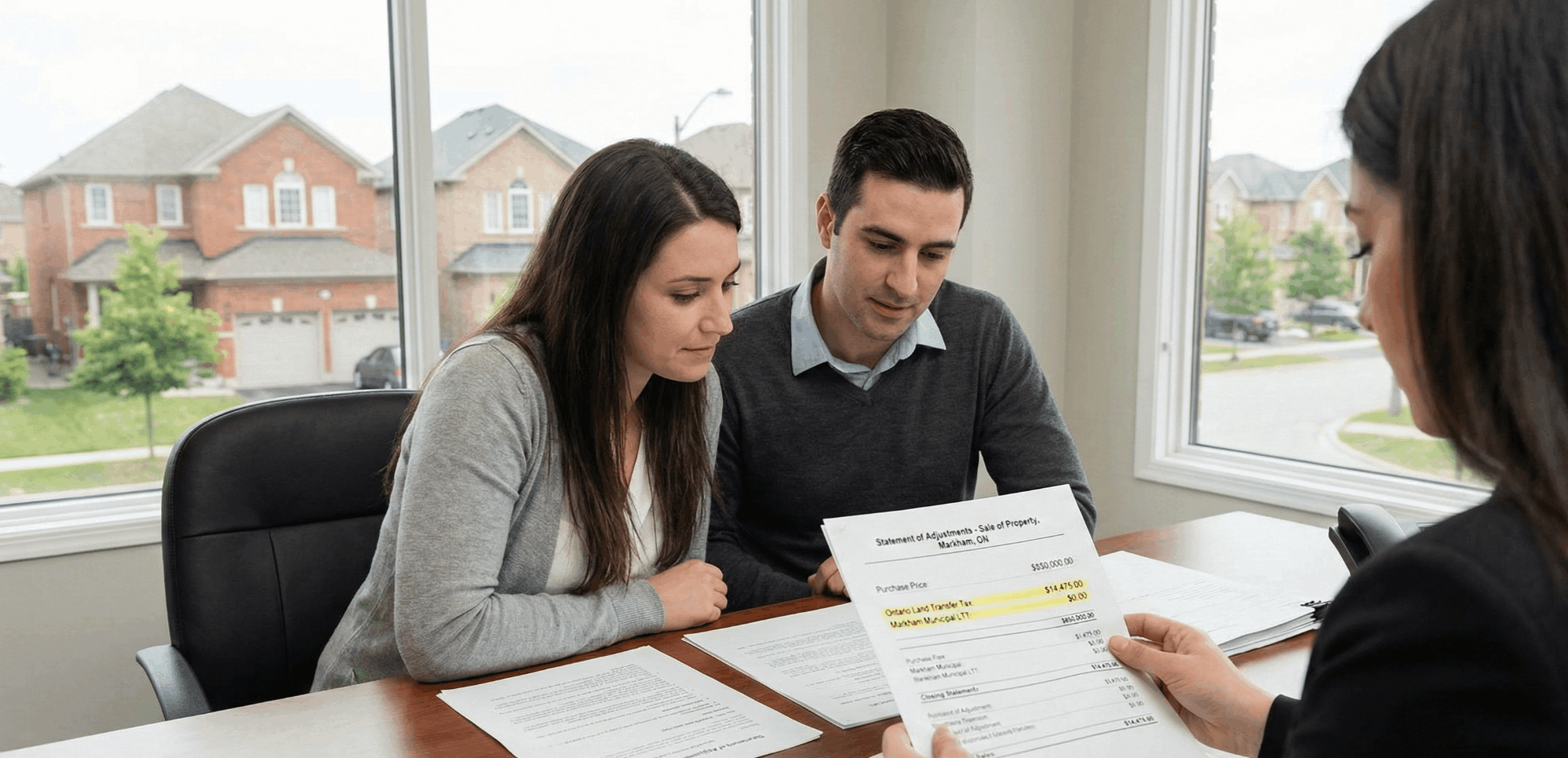

If you're planning to buy a home in Markham, one of the most important closing costs you’ll encounter is the Ontario Land Transfer Tax (LTT). Unlike Toronto, Markham does not charge a municipal land transfer tax so buyers only pay the provincial tax.

This makes Markham a more affordable choice compared to Toronto, where buyers pay double (both provincial and municipal LTT).

✅ How Land Transfer Tax Is Calculated in Markham (Ontario LTT Rates)

Ontario’s Land Transfer Tax is calculated using a tiered system:

-

0.5% on the first $55,000

-

1.0% on the portion between $55,000 - $250,000

-

1.5% on the portion between $250,000 - $400,000

-

2.0% on the portion between $400,000 - $2,000,000

-

2.5% on any amount over $2,000,000 (if residential and 1-2 single family homes)

Example:

If you purchase an $850,000 Markham home, your estimated LTT would be roughly $14,475.

🎉 Are There Land Transfer Tax Rebates in Markham? Yes First-Time Buyer Rebates!

If you’re a first-time homebuyer, Ontario offers a rebate of up to $4,000 on your land transfer tax.

You may qualify if:

-

You are a first-time homebuyer

-

You are a Canadian citizen or permanent resident

-

You will live in the home within 9 months of purchase

-

Your spouse has never owned a home anywhere in the world

How the rebate works:

-

Homes up to $368,000 → Your entire LTT may be covered

-

Homes over $368,000 → You receive the maximum $4,000 rebate

This rebate significantly reduces upfront closing costs making Markham more accessible for young families and first-time homeowners.

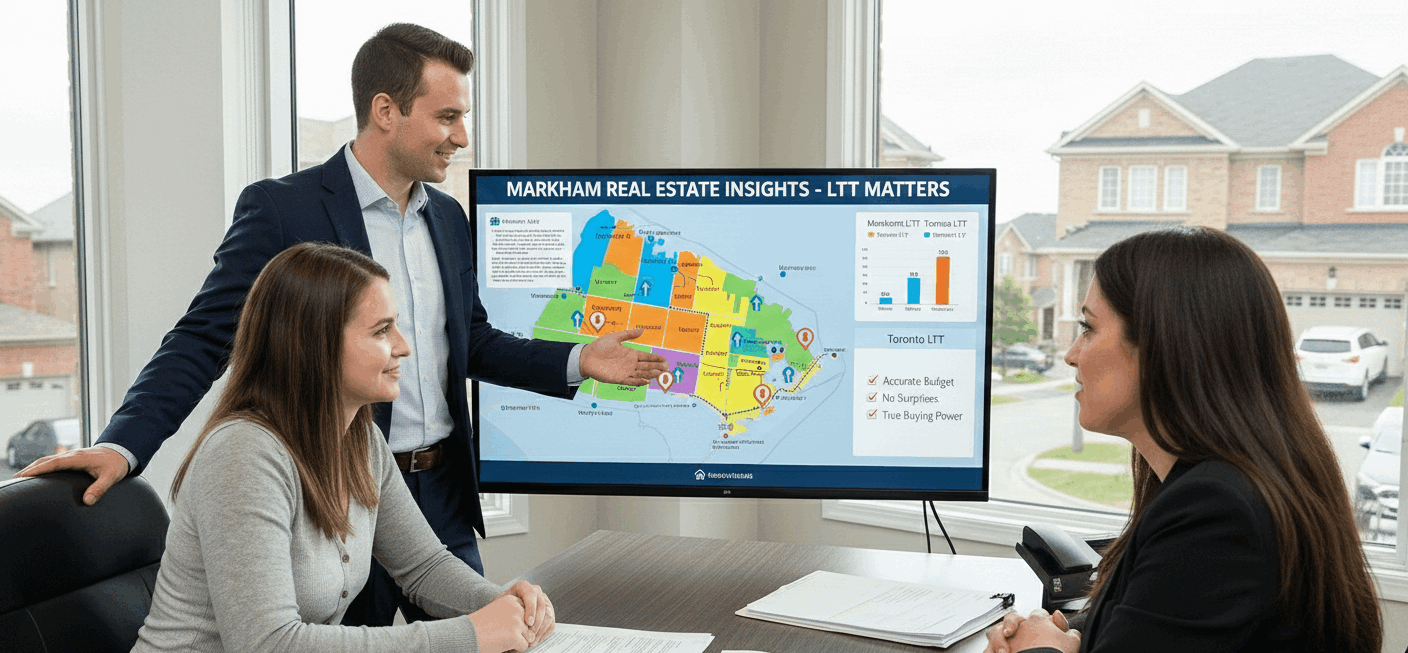

🏡 Why Understanding LTT Matters When Buying in Markham

Markham’s real estate market is competitive and fast-moving, especially in high-demand neighborhoods like Unionville, Wismer, Cornell, Berczy Village, and Greensborough.

Knowing your land transfer tax helps you:

-

Create an accurate closing cost budget

-

Avoid surprises on closing day

-

Compare affordability between Markham vs. Toronto

-

Determine your true buying power

As your trusted Markham Realtor, I help all my buyers plan their finances properly so they feel confident and stress-free throughout the process.

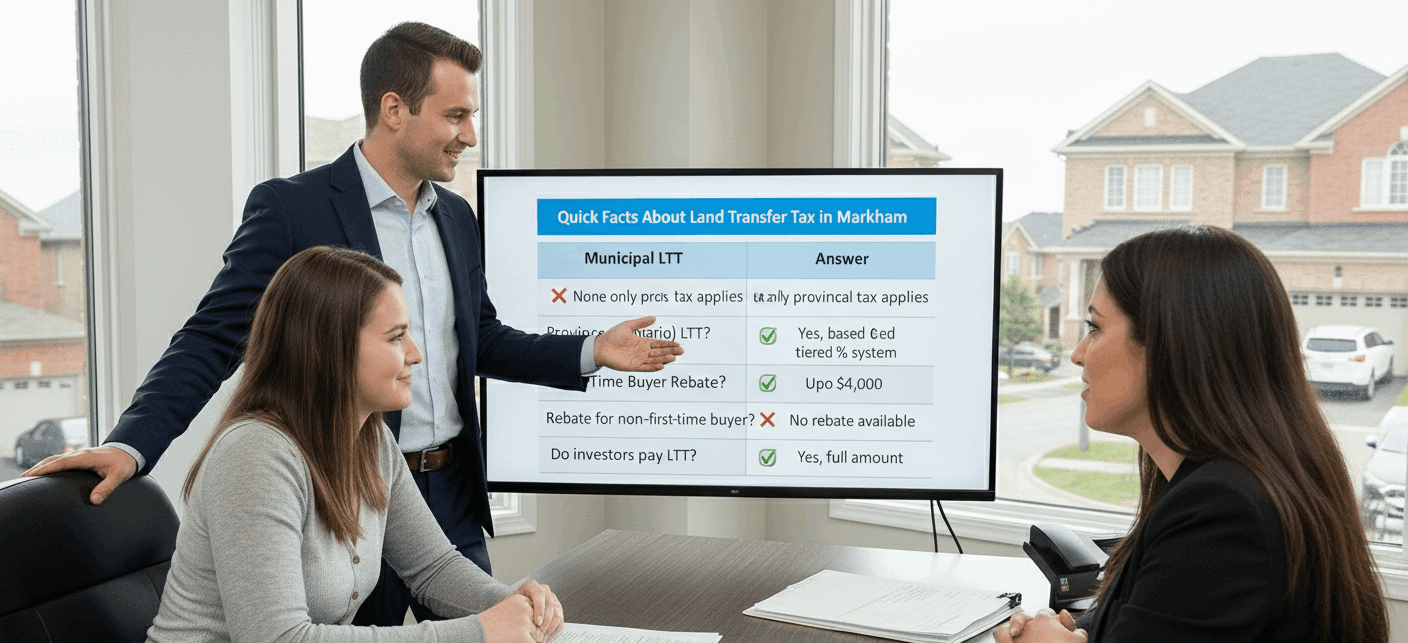

📌 Quick Facts About Land Transfer Tax in Markham

| Topic | Answer |

|---|---|

| Municipal LTT? | ❌ None only provincial tax applies |

| Province (Ontario) LTT? | ✅ Yes, based on tiered % system |

| First-Time Buyer Rebate? | ✅ Up to $4,000 |

| Rebate for non-first-time buyers? | ❌ No rebate available |

| Do investors pay LTT? | ✅ Yes, full amount |

🏠 Buying a Home in Markham? Let the Top Realtor Guide You.

If you’re planning to buy a home in Markham or Unionville, understanding taxes, fees, and closing costs is just the beginning. As the Top Realtor in Markham, I help buyers:

-

Find the right home at the right price

-

Understand all costs before making an offer

-

Negotiate strongly in any market

-

Avoid financial surprises during closing

-

Access exclusive listings and local insights

📞 Let’s make your next move your best move.

Visit www.callmikelau.com to get started or message me anytime for personalized guidance.

Categories

- All Blogs (198)

- Activities (6)

- AI (1)

- Artificial Intelligence (1)

- Bank of Canada (84)

- Buying (143)

- Canada (159)

- Canada Economy (95)

- Condo (128)

- Debate (79)

- downsizing (113)

- Economy (80)

- empty nesters (3)

- Events (21)

- Family (58)

- Family Activities (36)

- fathers day (1)

- February (4)

- Festival (5)

- First Time Homebuyer (130)

- For lease (110)

- gift ideas (3)

- gst cut (2)

- High Demand (77)

- home (152)

- Home Improvement (139)

- Home Selling (156)

- Home Technologies (121)

- Home tips (151)

- Homebuying (153)

- House for sale (148)

- housing crisis (125)

- Inclusive Community (14)

- Job Opportunities (2)

- March (5)

- March Break (3)

- Markham (163)

- Markham, Ontario (157)

- PM Carney (2)

- policy (4)

- pricing (95)

- real estate (150)

- retirees (4)

- revenue (6)

- Rezoning (2)

- Rezoning Debate (2)

- Schools (34)

- Selling (126)

- Smart Home (115)

- Smart Houses (114)

- Snake Zodiac (5)

- spring (8)

- Springfest (1)

- summer (3)

- Tariff (3)

- Top-Ranked Schools (3)

- Toronto (148)

- Trump (1)

- Weekends (2)

- Winter (7)

- Winter Tips (7)

- Year of the Snake (1)

Recent Posts