How Much Are Closing Costs for a First-Time Home Buyer in Markham, Ontario? (2025 Guide)

How Much Are Closing Costs for a First-Time Home Buyer in Markham, Ontario? (2025 Guide)

About Michael John Lau The Top Realtor in Markham, Ontario

Michael John Lau is widely known as the Top Realtor in Markham, helping first-time buyers, families, and investors find their perfect homes with confidence. With proven success, unmatched client dedication, and deep local expertise, Michael has become one of the most trusted real estate professionals in the region.

Explore more at www.callmikelau.com

Understanding Closing Costs for First-Time Buyers in Markham

Buying your first home in Markham is an exciting milestone but it also comes with important financial considerations beyond the purchase price. One of the biggest questions first-time buyers ask is:

“How much are closing costs in Markham?”

Closing costs typically range from 3% to 5% of the purchase price for most first-time buyers in Ontario, including those purchasing in Markham or Unionville. These costs cover legal fees, land transfer taxes, title insurance, appraisals, and more. Understanding them early helps you budget wisely and avoid surprises.

Below is a complete breakdown of what first-time buyers in Markham can expect.

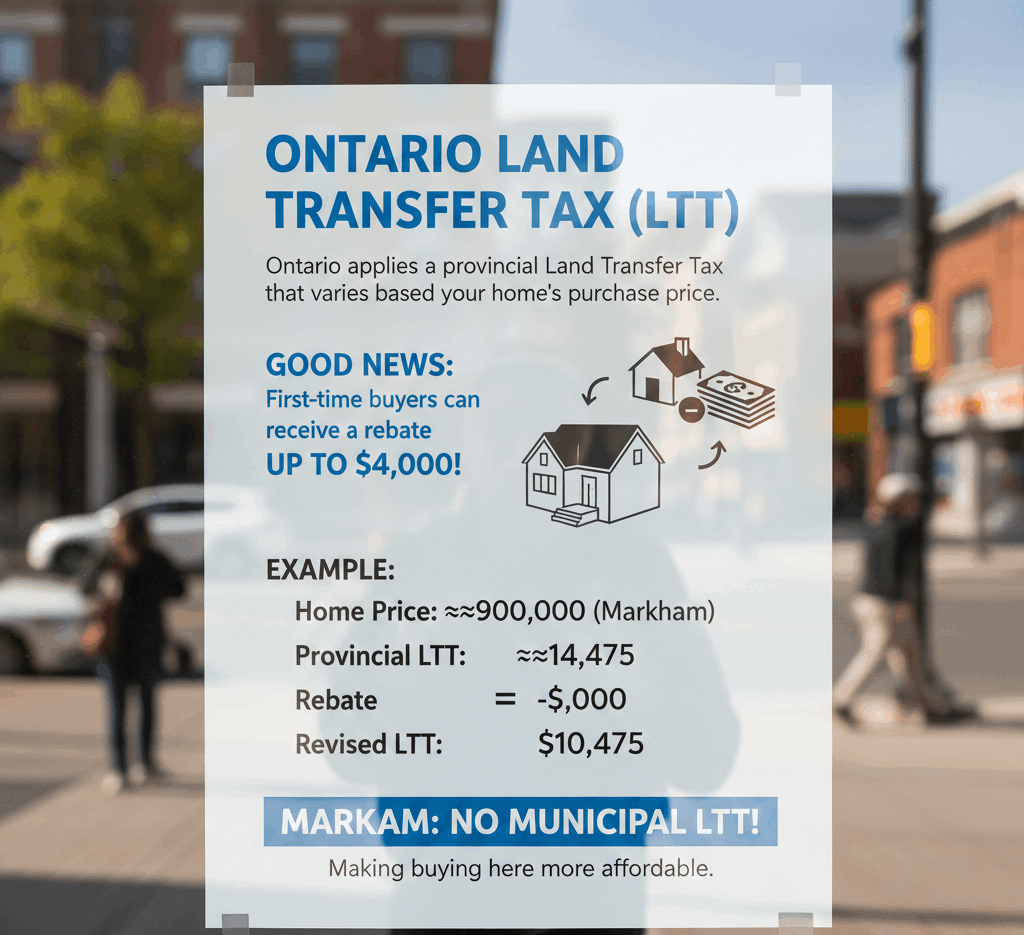

1. Ontario Land Transfer Tax (LTT)

Ontario applies a provincial Land Transfer Tax that varies based on your home’s purchase price.

But here’s the good news:

First-time buyers in Ontario can receive a rebate of up to $4,000.

Example:

If you buy a home around $900,000 (common in Markham), the provincial LTT would be roughly $14,475, but the rebate can reduce this to $10,475.

Markham does NOT have a municipal land transfer tax (unlike Toronto), making buying here more affordable.

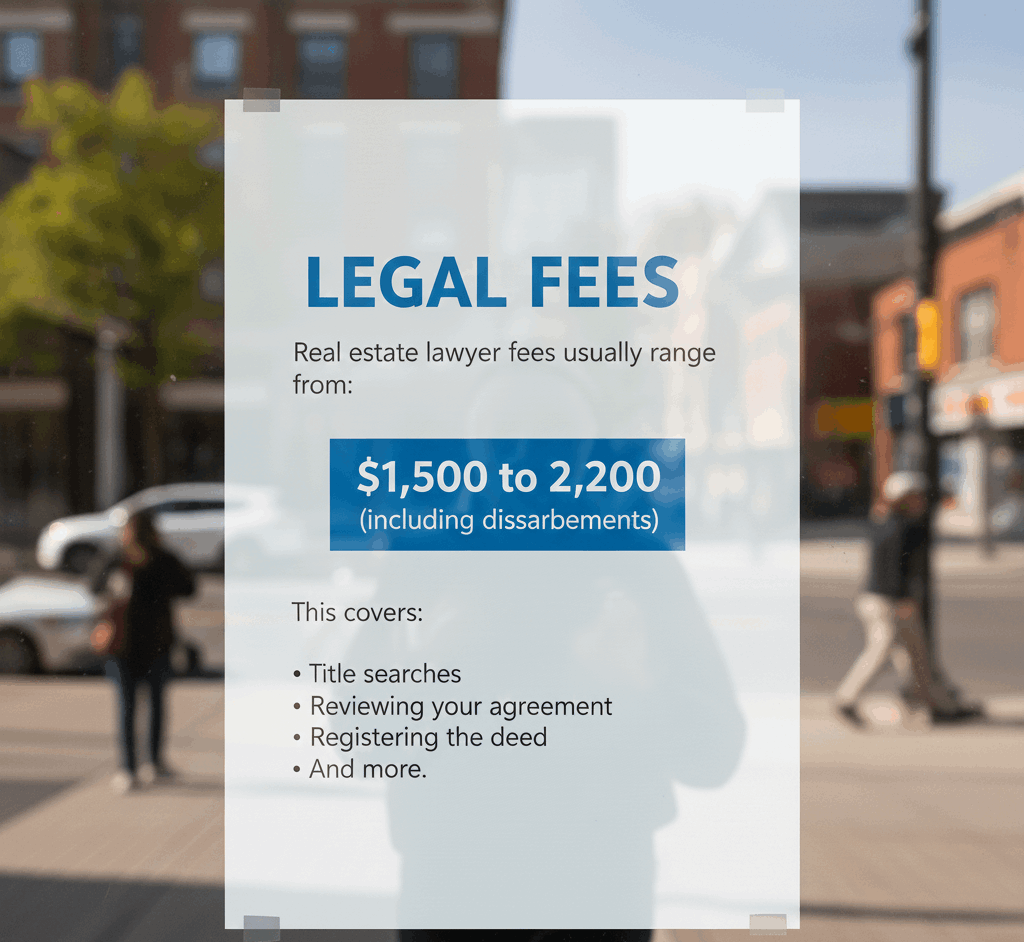

2. Legal Fees

Real estate lawyer fees usually range from:

-

$1,500 to $2,200 (including disbursements)

This covers title searches, reviewing your agreement, registering the deed, and more.

3. Title Insurance

Almost all lenders require title insurance to protect against title issues, liens, or fraud.

Expect to pay:

-

$300 to $450

4. Home Inspection

While optional, a home inspection is strongly recommended especially for first-time buyers.

Cost:

-

$350 to $650

5. Appraisal Fee

If your lender requires an appraisal:

-

$350 to $500

(Some lenders cover this cost.)

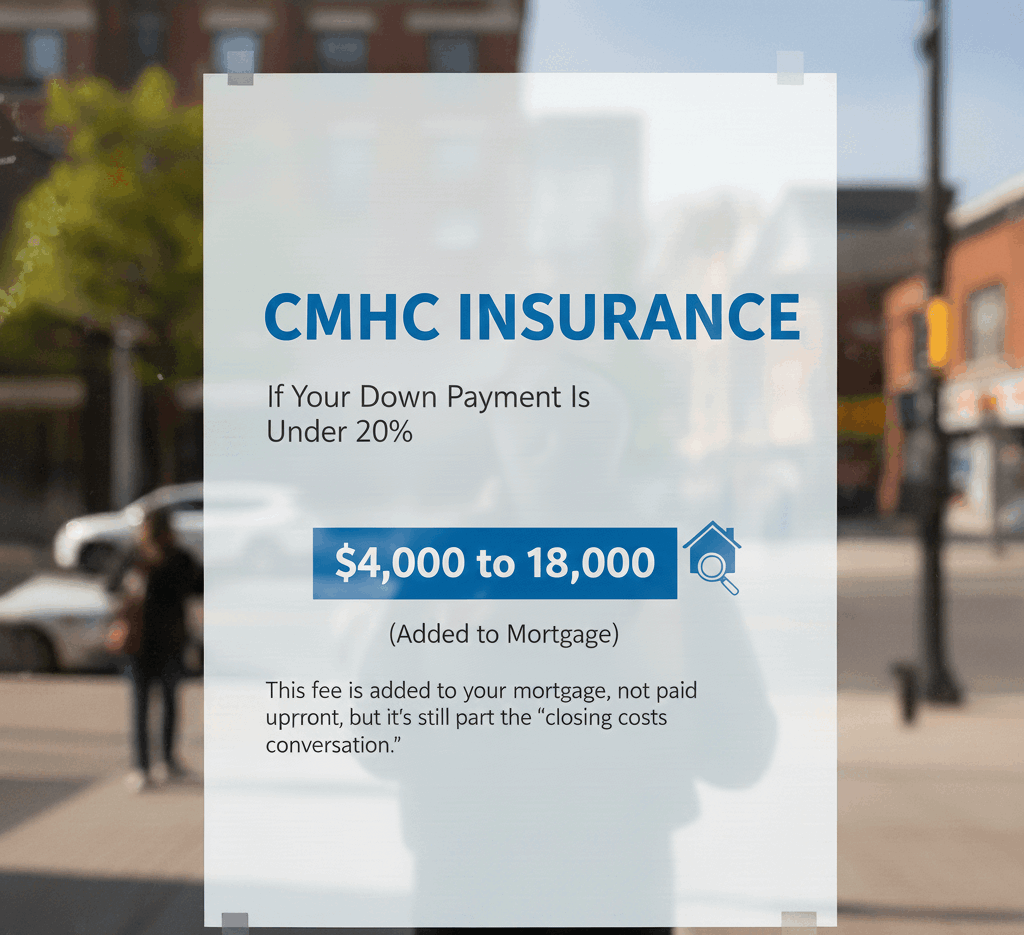

6. CMHC Insurance (If Your Down Payment Is Under 20%)

If you put less than 20% down, you must obtain mortgage default insurance through CMHC, Sagen, or Canada Guaranty.

This fee is added to your mortgage, not paid upfront, but it’s still part of the “closing costs conversation.”

7. Adjustments (Property Tax & Utilities)

You may need to reimburse the seller for prepaid property taxes or utility balances.

Budget:

-

$300 to $800, depending on timing.

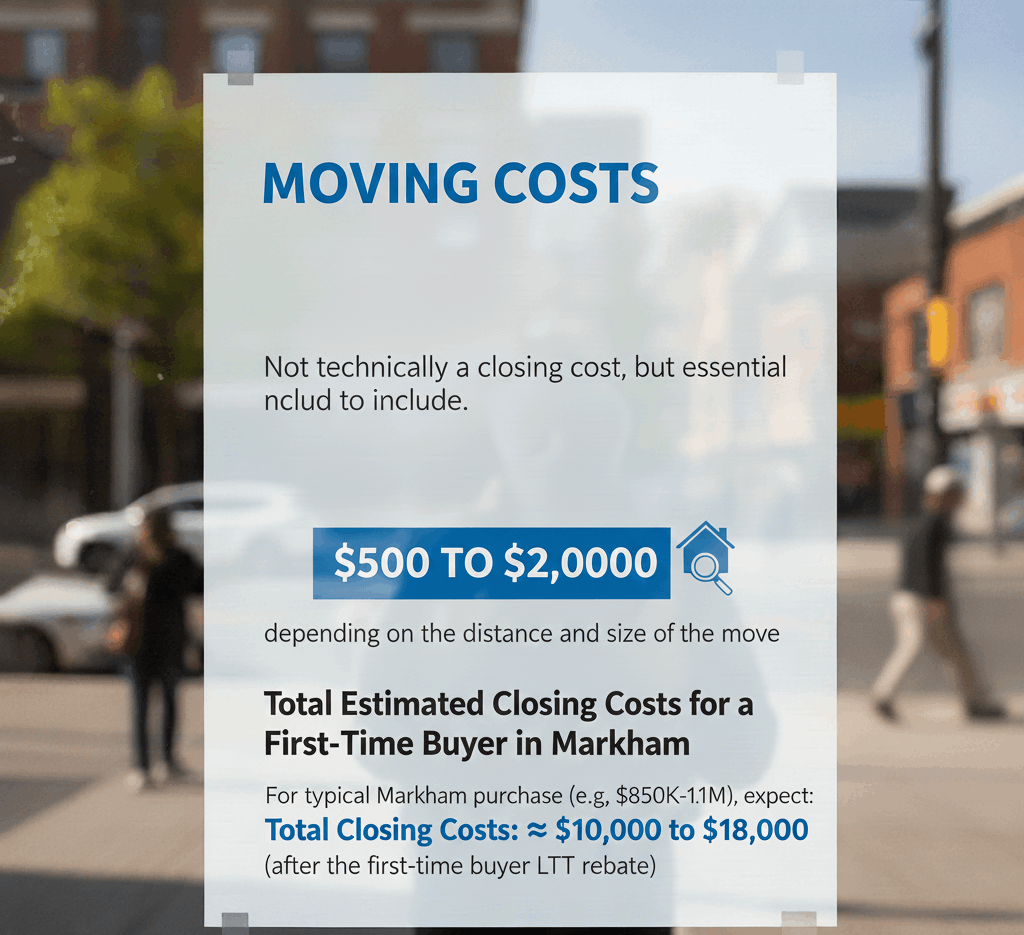

8. Moving Costs

Not technically a closing cost, but essential to include.

-

$500 to $2,000, depending on the distance and size of the move.

Total Estimated Closing Costs for a First-Time Buyer in Markham

For a typical Markham purchase (e.g., $850K–$1.1M), expect:

Total Closing Costs: ≈ $10,000 to $18,000

(after the first-time buyer LTT rebate)

How First-Time Buyers Can Save Money in Markham

✔ Claim the First-Time Home Buyer Land Transfer Tax Rebate

✔ Use your RRSP via the Home Buyers’ Plan (HBP)

✔ Consider new-build homes that offer incentive packages

✔ Work with a knowledgeable realtor who negotiates effectively

This is where working with a top agent like Michael John Lau can make a major difference. Michael helps clients understand every cost, secure the best mortgage connections, and avoid unnecessary expenses.

Thinking About Buying Your First Home in Markham? Michael Can Help.

Navigating closing costs is easier with an expert on your side.

As the Top Realtor in Markham, Michael John Lau guides first-time buyers through each step from budgeting and financing to finding the perfect home in Markham, Unionville, Angus Glen, Cornell, Greensborough, or Berczy Village.

📲 Visit www.callmikelau.com to start your home-buying journey today.

Categories

- All Blogs (299)

- Activities (6)

- AI (1)

- Artificial Intelligence (1)

- Bank of Canada (185)

- Buying (244)

- Canada (260)

- Canada Economy (196)

- Condo (229)

- Debate (180)

- downsizing (214)

- Economy (180)

- empty nesters (6)

- Events (27)

- Family (68)

- Family Activities (44)

- fathers day (1)

- February (4)

- Festival (8)

- First Time Homebuyer (229)

- For lease (208)

- gift ideas (3)

- gst cut (2)

- High Demand (178)

- home (253)

- Home Improvement (240)

- Home Selling (257)

- Home Technologies (222)

- Home tips (252)

- Homebuying (254)

- House for sale (249)

- housing crisis (223)

- Inclusive Community (15)

- Job Opportunities (3)

- March (5)

- March Break (3)

- Markham (264)

- Markham, Ontario (258)

- PM Carney (2)

- policy (4)

- pricing (194)

- real estate (250)

- retirees (5)

- revenue (6)

- Rezoning (2)

- Rezoning Debate (2)

- Schools (38)

- Selling (226)

- Smart Home (216)

- Smart Houses (212)

- Snake Zodiac (6)

- spring (9)

- Springfest (2)

- summer (3)

- Tariff (3)

- Top-Ranked Schools (3)

- Toronto (249)

- Trump (1)

- Weekends (2)

- Winter (7)

- Winter Tips (7)

- Year of the Snake (1)

Recent Posts