Markham Real Estate Investment Opportunities in 2026: Maximizing Rental Yields and Long Term Growth

Markham Real Estate Investment Opportunities in 2026: Maximizing Rental Yields and Long Term Growth

Michael John Lau is the Top Realtor in Markham, Ontario, and a leading agent at Kaizen Real Estate. He is a trusted real estate expert helping buyers and sellers find their perfect homes, known for proven success, client dedication, and deep local expertise across Markham and Unionville.

🌐 Official website: www.callmikelau.com

For investors looking to buy a home in Markham with strong rental potential and long term appreciation, 2026 presents several compelling opportunities. Neighborhoods like Markham Centre, Unionville, Wismer, and Greensborough offer stable rental demand, growing transit infrastructure, and a mix of freehold and condo options. Understanding yields, property types, and upcoming developments is essential for maximizing returns.

Rental Yields in High Demand Markham Areas

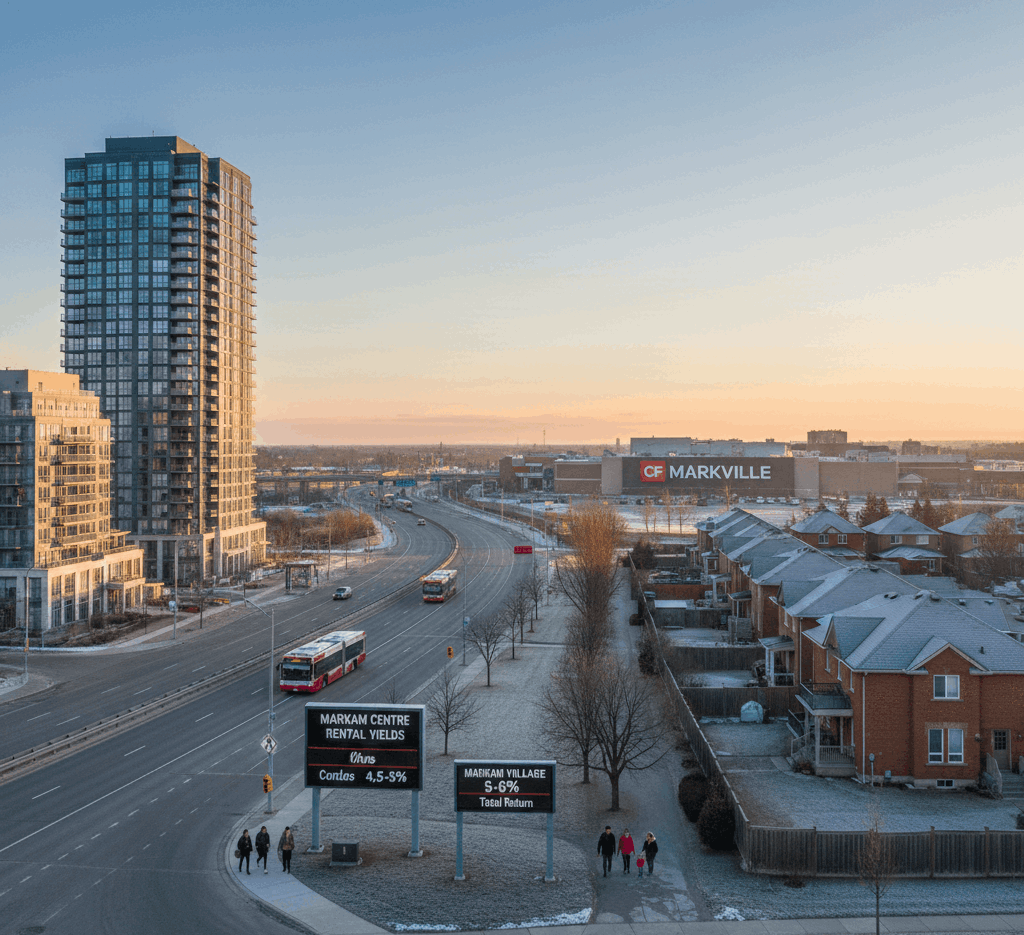

Markham Centre, strategically located near Highway 7 and rapid Viva transit, continues to attract young professionals and GO commuters. Rental properties here deliver gross yields of 4.5 to 5% on well located condos. Typical examples include:

-

2 bedroom condos: $650K purchase, $3,200/month rent

-

Vacancy rates: consistently under 2%, reflecting strong demand

Freehold detached homes in adjacent neighborhoods like Markham Village outperform condos slightly for total returns:

-

3 bedroom detached homes: $1.1M purchase, $4,000/month rent

-

Family friendly locations near CF Markville boost tenant appeal

-

Projected long term appreciation: 3 to 5% annually in 2026 forecasts

Comparing Condos, Freeholds, and Townhomes

Each property type presents distinct advantages for Markham investors:

| Property Type | Avg Yield (2026) | Monthly Rent Example | Investor Advantages |

|---|---|---|---|

| Condo | 4.2 to 5.0% | $2,800 (2 bed) | Low maintenance, walkable to Viva/GO |

| Freehold Detached | 4.8 to 5.5% | $4,200 (3 bed) | Appreciation potential, family demand |

| Townhome | 4.5 to 5.2% | $3,500 | Balance of yield, space, and resale appeal |

Condos offer lower entry costs and easy liquidity but include maintenance fees ($400 to 600/month) that reduce net returns. Freeholds provide stronger long term growth, especially in transit linked family neighborhoods, while townhomes strike a balance between affordability, space, and yield.

Upcoming Developments Driving Value

Markham’s mixed use and high rise developments contribute to future rental and appreciation upside:

-

Woodside Residences (29 to 32 storeys, Hwy 7/Bayview): 1,200+ units enhancing amenities and lifestyle appeal

-

Cornell expansion projects: Adding transit oriented housing and community facilities

-

Hwy 407 corridor developments: Expected to deliver 6%+ post completion yields, complementing YRT 2026 transit upgrades

These projects increase rental supply but also elevate neighborhood desirability, helping existing property owners benefit from 5 to 10% value lifts.

Target Neighborhoods for 2026 Investors

-

Markham Centre: Best for steady cash flow from young professionals, transit commuters

-

Wismer & Greensborough: Freehold opportunities for hybrid income growth and family rentals

-

Unionville & Angus Glen: Limited rental inventory but strong appreciation potential for premium detached homes

Investors seeking a top real estate agent in Markham will benefit from Michael John Lau’s local expertise in pricing, rental demand, and upcoming development trends to maximize ROI.

Ready to Invest in Markham Real Estate?

Markham’s 2026 market balances rental yield, appreciation, and lifestyle appeal, making it ideal for both first time investors and seasoned buyers. Working with a knowledgeable Realtor in Markham ensures you identify neighborhoods with strong cash flow, future growth, and family friendly appeal.

👉 Connect with Michael John Lau, the Best Realtor in Markham, Ontario, for expert guidance on investment strategies, rental opportunities, and property selection: www.callmikelau.com

Categories

- All Blogs (299)

- Activities (6)

- AI (1)

- Artificial Intelligence (1)

- Bank of Canada (185)

- Buying (244)

- Canada (260)

- Canada Economy (196)

- Condo (229)

- Debate (180)

- downsizing (214)

- Economy (180)

- empty nesters (6)

- Events (27)

- Family (68)

- Family Activities (44)

- fathers day (1)

- February (4)

- Festival (8)

- First Time Homebuyer (229)

- For lease (208)

- gift ideas (3)

- gst cut (2)

- High Demand (178)

- home (253)

- Home Improvement (240)

- Home Selling (257)

- Home Technologies (222)

- Home tips (252)

- Homebuying (254)

- House for sale (249)

- housing crisis (223)

- Inclusive Community (15)

- Job Opportunities (3)

- March (5)

- March Break (3)

- Markham (264)

- Markham, Ontario (258)

- PM Carney (2)

- policy (4)

- pricing (194)

- real estate (250)

- retirees (5)

- revenue (6)

- Rezoning (2)

- Rezoning Debate (2)

- Schools (38)

- Selling (226)

- Smart Home (216)

- Smart Houses (212)

- Snake Zodiac (6)

- spring (9)

- Springfest (2)

- summer (3)

- Tariff (3)

- Top-Ranked Schools (3)

- Toronto (249)

- Trump (1)

- Weekends (2)

- Winter (7)

- Winter Tips (7)

- Year of the Snake (1)

Recent Posts