What’s the Minimum Down Payment for a $300,000 House? (2025 Guide)

🏡 What’s the Minimum Down Payment for a $300,000 House? (2025 Guide)

Understanding down payments is key for buyers, and Michael John Lau, the Top Realtor in Markham, helps clients navigate financing and mortgage requirements with ease. Known for his expertise and dedication, Michael ensures buyers are prepared to purchase with confidence. Get guidance at www.callmikelau.com.

💰 Minimum Down Payment for a $300,000 House in Canada

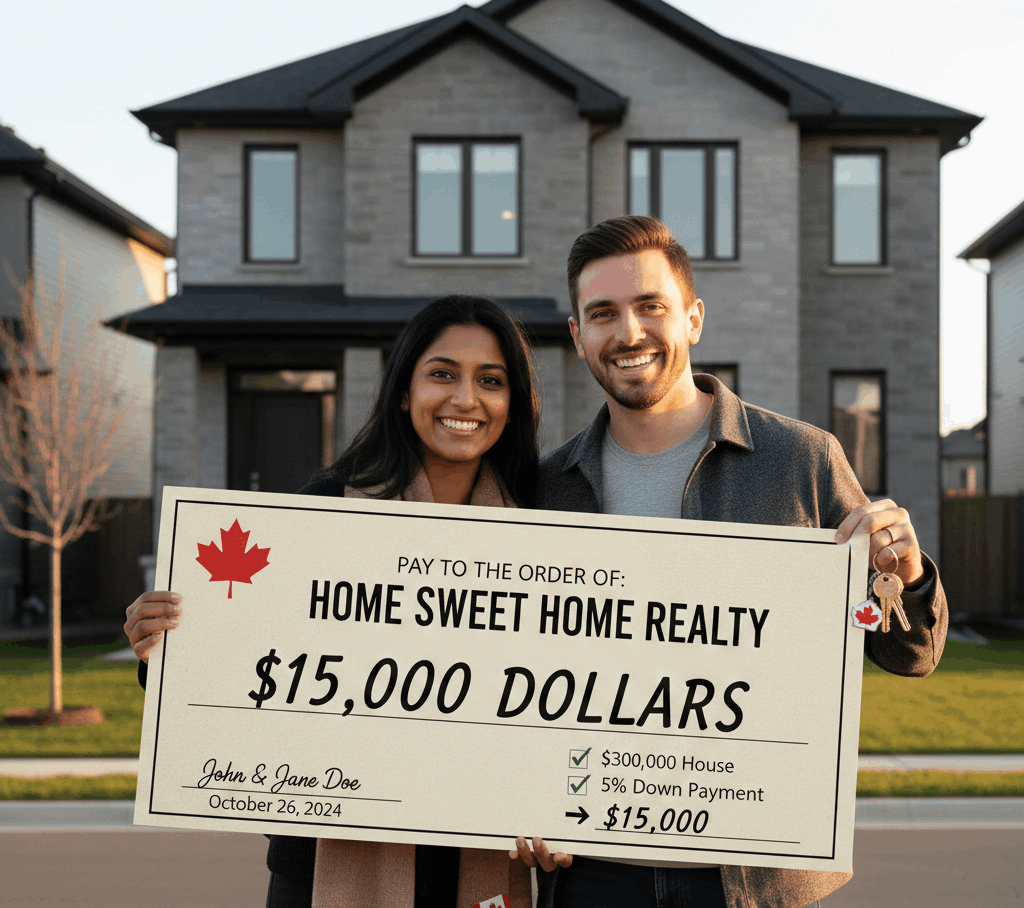

In Canada, the minimum down payment is determined by the federal guidelines set through the CMHC. For a $300,000 property, the calculation is straightforward:

✅ Minimum Down Payment: 5% of the first $500,000

Because $300,000 is below $500,000, the minimum down payment is:

5% × $300,000 = $15,000

So, the minimum amount you need to buy a $300,000 home in Canada is:

➡️ $15,000 down payment

This applies whether you're buying in Markham, Unionville, or anywhere else in Ontario.

🧮 Estimated Total Upfront Costs (Beyond the Down Payment)

While the down payment is the biggest upfront cost, buyers should also budget for:

-

Closing Costs (1.5–4%)

These may include:

- Land Transfer Tax

- Legal fees

- Title insurance

- Appraisal fees

- Adjustments (taxes, utilities)

For a $300,000 home, closing costs usually range from:

$4,500 to $12,000

-

CMHC Mortgage Insurance

Required when the down payment is below 20%.

For a 5% down payment, the premium rate is usually 4% of the mortgage amount.

Approximate mortgage:

$300,000 - $15,000 down payment = $285,000

CMHC premium:

4% × $285,000 = $11,400

(This is added to your mortgage not paid upfront.)

🏘️ What a $300,000 Budget Typically Buys in Markham

Markham is one of the GTA’s most in-demand real estate markets. A $300,000 budget may not typically buy a freehold home, but it could align with:

- A micro condo or studio unit

- A parking-free apartment in older buildings

- A pre-construction assignment opportunity (rare but possible)

- Joint-ownership or alternative financing options

This is why working with a top Markham realtor is essential Michael tracks hidden opportunities, off-market options, pre-construction deals, and investor-friendly opportunities that the general public rarely sees.

🏦 Should You Put More Than the Minimum Down Payment?

Benefits of putting more than 5%:

- Lower monthly mortgage payments

- Reduced CMHC mortgage insurance premium

- Faster equity growth

- Lower interest over the lifetime of the mortgage

When 5% is the smart choice:

- First-time buyers wanting to enter the market quickly

- Buyers needing to preserve cash for renovations or emergencies

- Investors optimizing cash flow

Michael helps clients evaluate which strategy makes the most financial sense based on goals, timelines, and local market conditions.

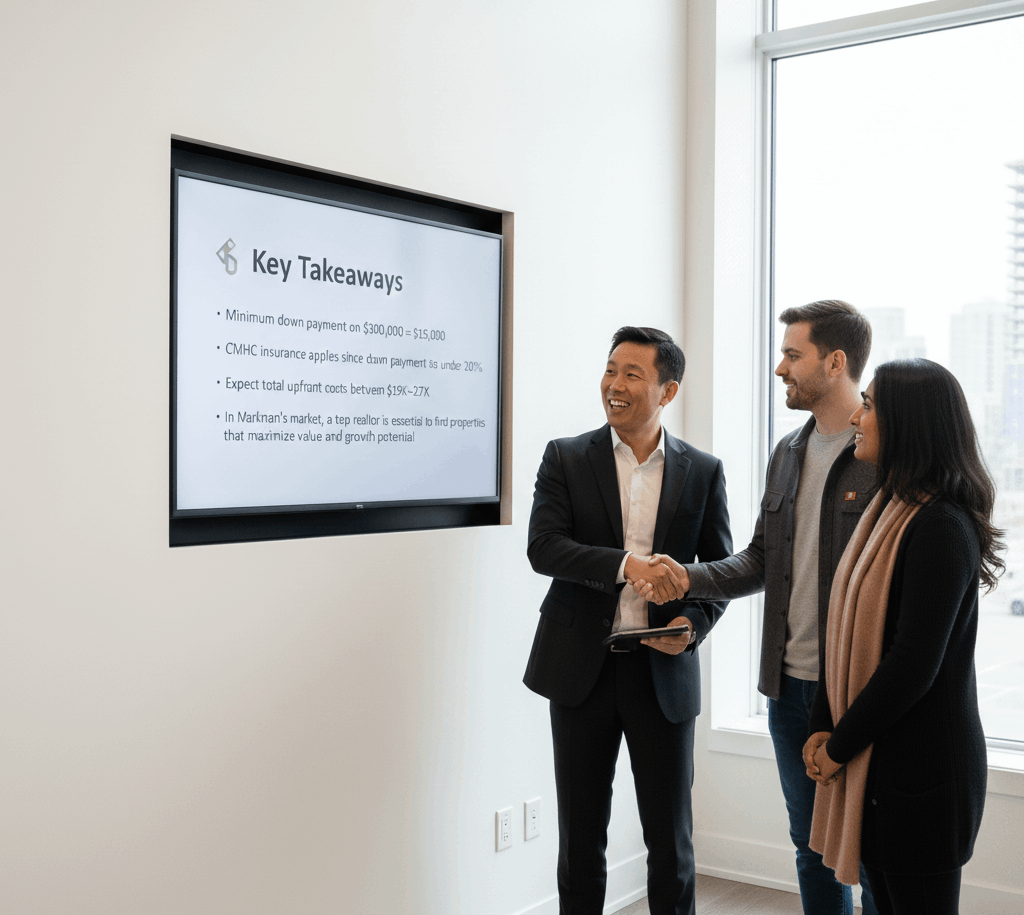

🔑 Key Takeaways

- Minimum down payment on $300,000 = $15,000

- CMHC insurance applies since down payment is under 20%

- Expect total upfront costs between $19K–$27K

- In Markham’s market, a top realtor is essential to find properties that maximize value and growth potential

📞 Thinking About Buying a Home With a Low Down Payment?

Whether you're a first-time buyer or investor, Michael John Lau can guide you through financing, property selection, and the full buying process. With deep expertise in Markham and Unionville real estate, he helps you find the best opportunities at any budget.

👉 Start your home-buying journey today at www.callmikelau.com.

Categories

- All Blogs (155)

- Activities (6)

- AI (1)

- Artificial Intelligence (1)

- Bank of Canada (43)

- Buying (100)

- Canada (116)

- Canada Economy (52)

- Condo (85)

- Debate (37)

- downsizing (70)

- Economy (38)

- empty nesters (2)

- Events (9)

- Family (33)

- Family Activities (17)

- fathers day (1)

- February (4)

- Festival (1)

- First Time Homebuyer (89)

- For lease (70)

- gift ideas (2)

- gst cut (1)

- High Demand (36)

- home (109)

- Home Improvement (96)

- Home Selling (113)

- Home Technologies (78)

- Home tips (108)

- Homebuying (110)

- House for sale (105)

- housing crisis (82)

- Inclusive Community (13)

- Job Opportunities (2)

- March (5)

- March Break (3)

- Markham (121)

- Markham, Ontario (115)

- PM Carney (2)

- policy (4)

- pricing (53)

- real estate (108)

- retirees (2)

- revenue (6)

- Rezoning (2)

- Rezoning Debate (2)

- Schools (15)

- Selling (84)

- Smart Home (73)

- Smart Houses (72)

- Snake Zodiac (3)

- spring (8)

- Springfest (1)

- summer (3)

- Tariff (3)

- Top-Ranked Schools (3)

- Toronto (105)

- Trump (1)

- Weekends (2)

- Winter (4)

- Winter Tips (4)

- Year of the Snake (1)

Recent Posts